Producers Expect To Plant More Cotton, Soybeans In ‘22

MR. ROBERT NATHAN GREGORY

STARKVILLE, MISSISSIPPI

More than half of the 4.29 million total acres of row crops expected to be planted this year in Mississippi are soybean fields, but the growth in cotton acreage may be the most significant increase over 2021.

The National Agricultural Statistics Service, a branch of the U.S. Department of Agriculture, released its annual prospective plantings report March 31. Surveys are conducted with farm operators nationwide during the first two weeks of March to collect data on planting intentions for the upcoming season.

The report estimates how many acres of soybeans, cotton, corn, rice and peanuts that producers intend to plant in the upcoming growing season. It also provides updated estimates of expected hay and winter wheat acreage. The report serves as a key market signal, as the acreage estimates will serve as the foundation of most row-crop supply projections for 2022.

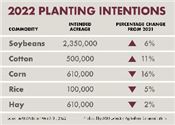

Soybean producers in Mississippi intend to plant 2.35 million acres in 2022, up 6 percent from last year. Cotton acreage intentions are at 500,000 acres, up 11 percent from the 450,000 acres planted last year.

Corn producers intend to plant 610,000 acres, which is down 16 percent from the 730,000 acres planted in 2021. Rice acreage is estimated at 100,000 acres, down 5 percent from last year.

Brian Pieralisi, a cotton specialist with the Mississippi State University Extension Service, said most of the cotton producers he has spoken with said they planned to plant more cotton this year as soon as last year’s harvest wrapped up.

“The acres originally intended for cotton in 2021 were higher than the harvested crop. We had a wet spring, which delayed planting and switched some intended cotton acres to soybean,” Pieralisi said.

“Part of the forecasted increase is getting back to the 2021 intended acreage, and the high commodity prices themselves were also a factor.”

Soybeans and cotton took some acreage from corn. MSU Extension corn specialist Erick Larson said that even with the decreased intended acreage, 610,000 acres would still exceed the state’s five-year average.

“Corn requires more nitrogen fertilizer than the other row crops we grow, and considering the substantial increase in fertilizer expenses and other agricultural inputs is playing into the intention estimates,” Larson said. “This estimate is still a solid acreage for corn. The weather we have in April will play a major role in how much is actually planted compared to the estimate since there were so few opportunities to plant in March because of cold and rainy weather.”

Will Maples, MSU Extension agricultural economist, said high input costs limited producer willingness on a national level to bring more land into production.

“In years past, when we have seen the type of commodity price increase we have seen over the past year, we would expect to see an increase in total planted acreage,” he said. “This acreage response just didn’t occur this year.

“There was a lot of uncertainty due to high commodity prices, but also high costs across all inputs and supply concerns,” Maples added.

“It was a perfect storm of factors that many farmers have probably never faced when making a crop mix decision. We have seen significantly higher chemical, seed, and fertilizer costs this spring than last year.”

Total principal acreage in Mississippi was up 1 percent from 2021; the main change was the crop mix.

“The main driver for soybeans was high prices and the lower input costs compared to other crops,” Maples said. “Cotton was driven by higher market prices, while high input costs hurt corn acreage this year. Rice acreage remained flat from last year due to weaker market prices and high inputs relative to other crops.”

Maples said a key item in the USDA report was how corn and soybean acreage would be split nationwide. Soybean intentions for the entire country are up 4 percent, while corn intentions are down 4 percent.

“I personally leaned toward us planting more corn than soybeans, given market signals of high corn prices relative to soybeans. On the other hand, there was an argument for more soybeans being planted due to high fertilizer costs and supply concerns on inputs,” he said.

“Soybeans are a cheaper crop to grow and use less fertilizer than corn. It looks like the higher input cost argument won with 90 million acres of soybeans and 89.5 million acres of corn planted nationally.”

Internationally, Brazil has faced severe drought this spring in its southern soybean-growing region during sensitive crop stages. USDA initially projected Brazil to have a record soybean crop this year, but due to drought conditions, production fell to 8 percent lower than 2021.

“This has led to stronger U.S. soybean exports through January and February than normal,” Maples said, “which has supported the soybean market.”

All hay acres expected to be harvested in Mississippi are estimated at 610,000 acres, down 10,000 acres from 2021. Winter wheat acreage in Mississippi is up 5 percent from last year to an estimated 100,000 acres in 2022. Peanut producers plan to plant 20,000 acres, up 11 percent from 2021. ∆

MR. ROBERT NATHAN GREGORY: MSU Extension Service