|

Live Cattle And Feeder Cattle Basis

DR. ANDREW P. GRIFFITH

KNOXVILLE, TENN.

Most agricultural commodities are traded on the cash market in some form or fashion whether that is taking feeder cattle to the local auction market or hauling corn to the local grain elevator. Similarly, most of these same commodities are traded on the Chicago Mercantile Exchange (CME) in the form of futures contracts. Thus, there is a cash market and a futures market trading simultaneously throughout the year for the same commodity. However, the price of the futures contract is rarely exactly the same as the local cash price being offered, and the difference between the cash and futures contract price is different depending on one’s location. The difference between the cash price and the futures price is known as basis (cash minus futures equal basis).

Why does basis matter, and what does it mean for me? Please continue reading.

The futures market is supposed to provide a broader view of the underlying fundamentals in a market. In other words, the futures market is evaluating the current supply and demand situation as well as evaluating the future supply and demand situation of a commodity. When expectations are brought into the equation, market prices change based on those expectations. However, local cash markets may have a slightly different supply and demand situation than the broader market which subsequently influences the cash price received resulting in the basis value.

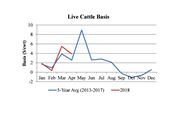

Basis has been at the forefront of many cattle industry participants minds the past couple of months due to the extremely wide basis in live/finished cattle. Live cattle futures has contracts for February, April, June, August, October and December. As the market moves closer to the end of a contract, the cash price and the futures price should converge. However, that is not always the case, and what about a situation when it is the first of May and the closest contract is the June contract? The figure included with this article illustrates monthly live cattle basis for 2018 and the monthly five year average basis (2013-2017). As can be seen in the figure, the basis in March and April of 2018 has been extremely strong relative to previous years which mean futures contracts are selling at a heavier discount in 2018 than in the previous five years.

Basis for live cattle tends to be strongest in May. The strong basis in May occurs for a couple of reasons. The first reason is strong beef demand as grilling season starts. The second reason is because the June futures contract is pricing in the increased supply of finished cattle that will be coming to market in June. This increase in supply is largely due to calf-fed animals placed on feed in the fourth quarter of the previous year. Thus, June futures typically sell at a large discount relative to cash live cattle trade in May.

The accompanying graph depicts the strong May basis the past five years. However, May basis the first couple of weeks in 2018 was closer to $20 per hundredweight which is more than double the five year average. This record setting basis was spurred by strong beef demand and futures traders with a fear that a mountain of beef is on the horizon. By the time this article is published, cattle market participants may know if the mountain of beef has arrived or if the mountain is more of a mole hill.

The strong basis promotes cattle feeders to market inventory in the near term as opposed to in the future because the expectation is for cash prices to decline. Thus, moving from the month of May to June, the futures market is insinuating finished cattle prices will decline about $20. However, convergence of the cash price and the futures price is more likely to come from a decline in cash prices and an increase in futures prices. Which one moves the most is yet to be determined.

This price action is important to feeder cattle producers because cattle feeders have to purchase feeder cattle based on the price expectation of live cattle five to seven months down the road. If the previous six months are any indication of the next six months then live cattle futures will continue to be severely discounted until close to the expiration of the futures contract which will soften feeder cattle prices. ∆

DR. ANDREW P. GRIFFITH: Assistant Professor, Department of Agricultural and Resource Economics, University of Tennessee

|

|